Planning a Lumpsum Investment?

We help you to deploy extra Earnings better, so that you can get bigger ones later!

What about starting a Systematic Investment Plan (SIP)

And You Thought To Create Wealth Large Investments are required. Start Small ! Start A SIP !!

Have you planned for your Retirement

The world's longest coffee break is often referred to as retirement. Are you ready?

Why Choose Us

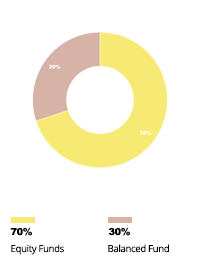

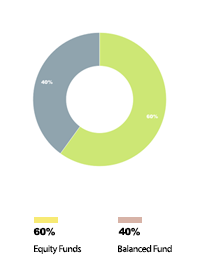

Customized Portfolios

Investments should be based on your risk taking ability and time horizon, it could be for a few days to many years. Therefore, we do customize investments suiting these need of yours.

Draw a Plan

Once we know your investment needs and risk profile, we draw a plan by selecting the right funds or solutions by avoiding biases. A plan, if drawn well, helps you reach your financial goals easily.

Review and Rebalance

As markets are ever changing, we continue to review the plan, and if necessary, rebalance the investments by eliminating the non-performers and replace them with performers.

Higher Education Goal

The rising costs of higher education coupled with the stress of paying student loans are putting increasing pressure on students.

- We identify your Child's High Education needs

- We draw a plan by accounting the Existing and Future Investments to meet the Goal

- We ensure that you invest in the right assets so that you Child's Higher Education Goal is not compromised

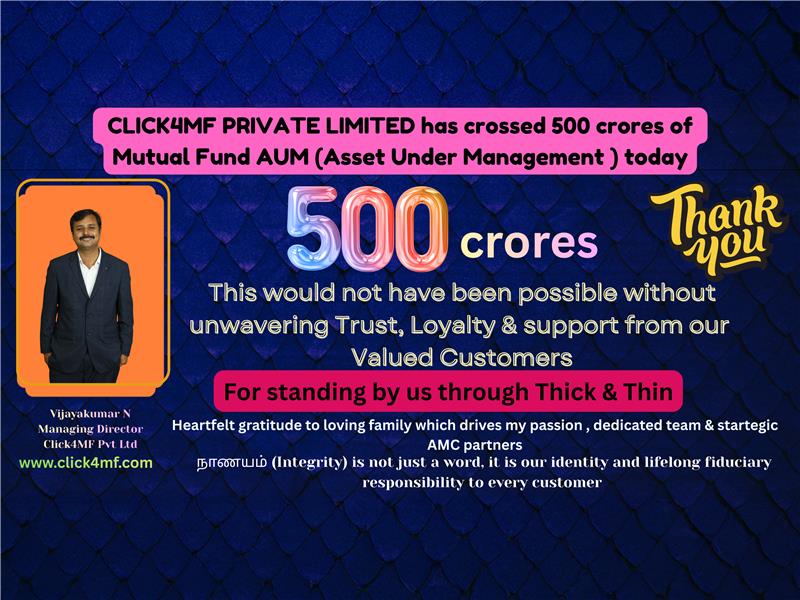

How CLICK4MF Private Limited Works in Your Best Interest

Monthly Investment

AFTER 25 YEARS, IT WOULD HAVE ACCUMULATED TO

Bank

र

@3% Return

Fixed Deposit

र

@6% Return

Gold

र

@9% Return

Sensex

र

@11% Return

CLICK4MF

र

@15% Return

What you can explore on our Website?

Not Sure how your Mutual Funds are doing?

Review an existing MF portfolio with a simple E-CAS upload and get a detailed return analysis.

Identify Laggards

Upload your CAS and identify the schemes that are underperforming

More Returns

Restructure your portfolio with our assistance and earn more returns in the long run

Check Risk Profile

We will ask you a set of questions to get to know you!

Check Risk Profile

We will ask you a set of questions to get to know you!

Check Risk Profile

We will ask you a set of questions to get to know you!

also suffered the same - what would be your first impulse?

Check Risk Profile

We will ask you a set of questions to get to know you!

Check Risk Profile

We will ask you a set of questions to get to know you!

as a bank fixed deposit, you must take risks.

Check Risk Profile

We will ask you a set of questions to get to know you!

Your Risk Tolerance

As per our risk assessment, you Risk Profile is

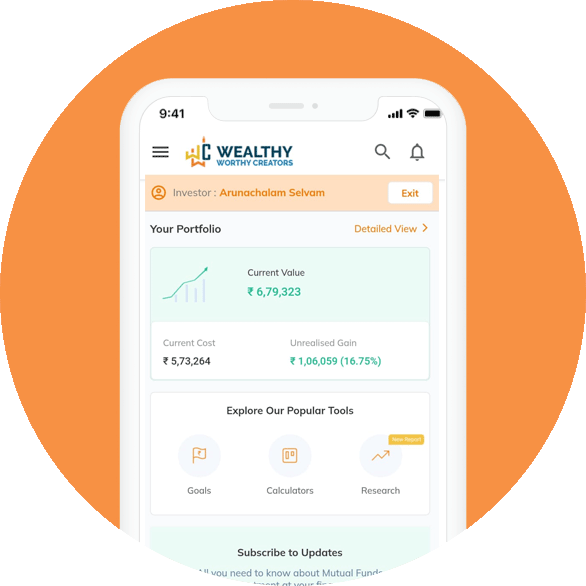

Get access to all the information you need.

Yes, right! Our Portfolio Tracker not only helps you track your investments but you Goals as well.

Goal Tracking ensures that you are on track to reach the respective Financial Goals and take corrective action, if required. You guide you through this journey!

Create Your Goals

We help you plan and reach your various Financial Goals. Please explore!

Planning a SIP

Start small, but start sure with a SIP investment and create wealth! Start a SIP!

Plan One-Time Investment

Whenever you get a Bonus or some additional cash, do take help of this Tool!

Get a Free Consultation

Contact Address

PLOT NO.C1, 2ND FLOOR, 1ST MAIN ROAD, MAXWORTH NAGAR,

PHASE 2, KOLAPAKKAM, PORUR, CHENNAI-600122, TAMIL NADU.(Opp. to Pon Vidyashram School)

Office Contact

+91 - 98840 76737

Mail Us For Information

info@click4mf.com

Funds which have given highest SIP returns

The result displays category-wise list of 5 funds which have given the highest SIP returns in the last 5 years. Monthly SIP amount assumed is Rs 10,000 and the SIP investment date is 1st of every month. We are showing Annualized returns as well as the current value of monthly SIP of Rs 10,000. Click on 'See More' to see the SIP returns of all funds in the chosen category.

| 1Y | 3Y | 5Y | ||||

|---|---|---|---|---|---|---|

| Scheme Name | Rtn (%) | Amount | Rtn (%) | Amount | Rtn (%) | Amount |

| Loading... | ||||||

Fund category returns

| Category | Avg Ret (%) | Max Ret (%) | Min Ret (%) |

|---|

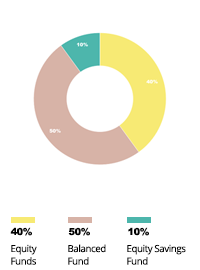

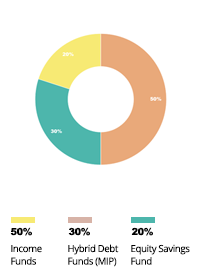

We match your Investment Objectives with the right Model Portfolios

Watch Us!

Latest Blogs

What should long term investors do when there is a war

The Russian invasion of Ukraine has rocked global equity markets. After weeks of simmering tension b...

Should you invest in small caps

Small cap mutual funds category attracts investors' interest from time to time. Investors usually pr...

What are Multi Cap Funds

Multicap mutual funds are diversified equity mutual fund schemes which invest across market cap segm...

Testimonials

I have known Mr. VijayaKumar over one year now and both me and my wife have taken his advice on investments, especially in mutual funds...

S. Narayan IAS (Retired)

Mr. Vijayakumar has been helping me manage my investments for more than 10 years. His commitment and service quality are excellent.

K. Balasubramanian

As a personal financial advisor, Mr. Vijayakumar is a complete professional who provides financial advice and services to clients...

Karthik Ramaswamy

Mr. Vijaykumar, Genuine interest, knowledge and Passion in achieving the goal for clients make a true professional investment advisor. You have this and more...